rolex watch hs code | hsn code for watches rolex watch hs code US Hs Tariff Code of Chapter-91 Clocks and watches and parts. Wrist and . $4,300.00

0 · wrist watch hsn code

1 · hsn code for watches

2 · hs code for wall clocks

3 · hs code 91 watch parts

4 · clock hs code

Get the best deals on OMEGA Seamaster Wristwatches 1960-1969 when you shop the largest online selection at eBay.com. Free shipping on many items | Browse your favorite brands | affordable prices.

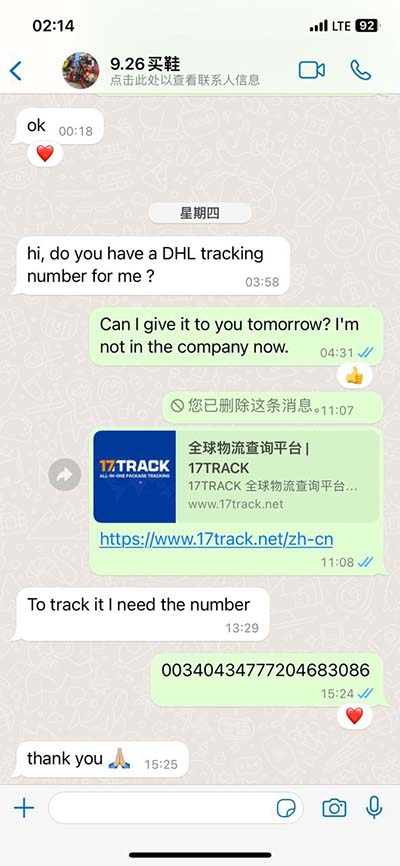

Not only is the USPS through EMS not very secure, it may also come with a secondary issue, requiring a customs broker. This has happened to me multiple . See moreThe method for collection varies from company to company. This is another disadvantage to using EMS/USPS. It is generally extremely simple, you just have to . See moreI’ve been there before, this is a pain to deal with and financially, not very nice. This is the single biggest problem with importing watches. If something happens . See more

buberry sale

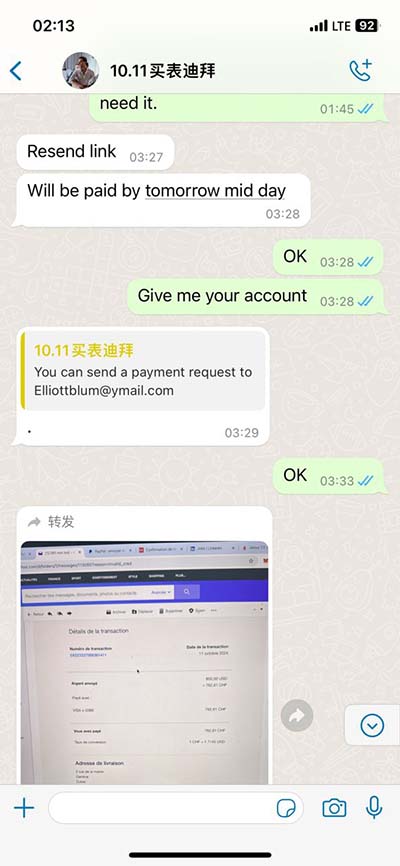

Selling an imported watch follows the same process as selling any other watch. As the new owner, you need to ensure you list the watch on suitable platforms that . See more US Hs Tariff Code of Chapter-91 Clocks and watches and parts. Wrist and .HTS Code 9102.21.70. This part of the code relates to the most common watches, specifically your everyday automatic watch movement. Wrist watches, not battery powered, base metal case, with automatic winding, having over 17 jewels, with band of textile or base metal. Movement – .US Hs Tariff Code of Chapter-91 Clocks and watches and parts. Wrist and pocket watches, panel clocks, Vehicles, aircraft and spacecraft apparatus. Synchronous motor incomplete watch bracelets.

Find accurate Rolex watches HSN Code from 21 options. HS Code 91022100 is most popular, used in 7.2M+ export import shipments.

The applicable subheading for the Rolex submariner watch will be 9102.21.70, Harmonized Tariff Schedule of the United States (HTS), which provides for Wrist watches, . other than those of heading 9101: Other wrist watches . For watches, around 3% seems to right as I have had multiple watches sent to me from out of the US before being charged 3% ish custom tax. The bigger bill is actually CA sales tax at 9% which gets generated automatically when custom is paid. The systems are linked.HTS Code: 9102.11.25Wrist Watches, Battery Powered, With Cases Of Materials (exc. Below is a sample of the information available on HTS 9102.11.25 in Descartes Datamyne's extensive global trade database.

HS Code, which is short for The Harmonized Commodity Description and Coding System, is a worldwide standardized system of codes for determining a type of commodity being shipped. In every country around the world, commodities shipped through their borders have to be declared using these codes.Just look up what the customs tariff for HS code 9101.11 is, I would do it for you if I wasn't on my phone here. And as for what DHL takes for their sercices, here's a link to the brochure with service charges - at least the 2%/ disbursement fee will apply.Search Rolex watch HS Code for Rolex watch import and export at seair.co.in. We also provide Rolex watch import data and Rolex watch export data with shipment details.Rolex Watch worth 3,445,359 under Sub Chapter 9102 have been imported; Average import price for rolex watch under Sub Chapter 9102 was ,490.29. Please use filters at the bottom of the page to view and select unit type. You may also use the analysis page to view month wise price information.

HTS Code 9102.21.70. This part of the code relates to the most common watches, specifically your everyday automatic watch movement. Wrist watches, not battery powered, base metal case, with automatic winding, having over 17 jewels, with band of textile or base metal. Movement – .

US Hs Tariff Code of Chapter-91 Clocks and watches and parts. Wrist and pocket watches, panel clocks, Vehicles, aircraft and spacecraft apparatus. Synchronous motor incomplete watch bracelets. Find accurate Rolex watches HSN Code from 21 options. HS Code 91022100 is most popular, used in 7.2M+ export import shipments.The applicable subheading for the Rolex submariner watch will be 9102.21.70, Harmonized Tariff Schedule of the United States (HTS), which provides for Wrist watches, . other than those of heading 9101: Other wrist watches .

For watches, around 3% seems to right as I have had multiple watches sent to me from out of the US before being charged 3% ish custom tax. The bigger bill is actually CA sales tax at 9% which gets generated automatically when custom is paid. The systems are linked.

HTS Code: 9102.11.25Wrist Watches, Battery Powered, With Cases Of Materials (exc. Below is a sample of the information available on HTS 9102.11.25 in Descartes Datamyne's extensive global trade database.HS Code, which is short for The Harmonized Commodity Description and Coding System, is a worldwide standardized system of codes for determining a type of commodity being shipped. In every country around the world, commodities shipped through their borders have to be declared using these codes.

Just look up what the customs tariff for HS code 9101.11 is, I would do it for you if I wasn't on my phone here. And as for what DHL takes for their sercices, here's a link to the brochure with service charges - at least the 2%/ disbursement fee will apply.Search Rolex watch HS Code for Rolex watch import and export at seair.co.in. We also provide Rolex watch import data and Rolex watch export data with shipment details.

cartier lvoe ring

wrist watch hsn code

buy versace home residential apartments jordan

hsn code for watches

hs code for wall clocks

$ 12,250. Buy in monthly payments with Affirm on orders over $50. Learn more. Add to Bag. The Rolex Submariner Reference 5513 is the embodiment of the classic dive watch. .

rolex watch hs code|hsn code for watches